Orthodontic care can sometimes feel overwhelming, especially when managing the financial aspects. Fortunately, Patuxent Orthodontics simplifies the process by partnering with Maryland’s top insurance providers.

This guide will walk you through how these collaborations make your journey to a perfect smile accessible and affordable.

Whether you’re considering braces for yourself or your child, understanding how your orthodontic care can be seamlessly integrated with insurance coverage will help you feel more secure and informed as you start your treatment.

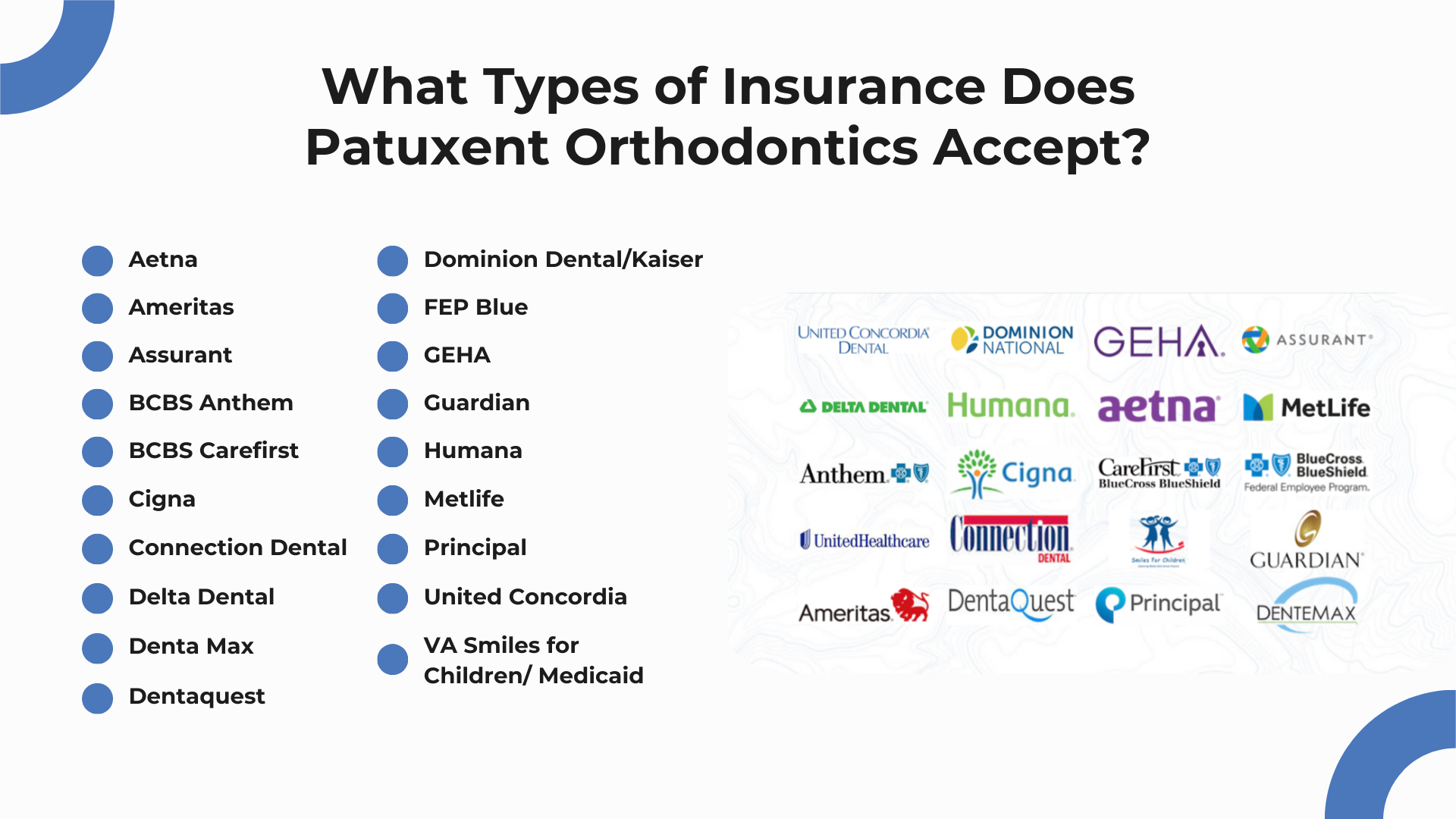

What Types of Insurance Does Patuxent Orthodontics Accept?

Patuxent Orthodontics offers comprehensive orthodontic care and accepts a wide range of insurance plans, ensuring patients can access treatments without financial stress.

Whether you’re considering traditional metal braces, ceramic braces, lingual braces, or clear aligners, our flexible dental insurance coverage makes it easier to manage the cost of braces.

We proudly support a variety of dental insurance plans, including major providers such as Aetna, Cigna, Delta Dental, and many more. Our commitment is to make orthodontic treatment accessible to as many patients as possible, offering various payment plans to suit different budgets and needs.

For your convenience, we will submit the claim to your insurance company and accept available benefits directly so that you are only responsible for the uncovered portion of treatment.

Does Patuxent Orthodontics Work with Specific Maryland Insurance Providers?

Yes, Patuxent Orthodontics collaborates with specific Maryland insurance providers to streamline the process of obtaining braces and other orthodontic treatments.

Our insurance partners include well-known health insurance companies like BCBS Anthem, BCBS Carefirst, United Concordia, and VA Smiles for Children/Medicaid. By working closely with these providers, we ensure that patients receive the maximum benefits from their insurance plans, minimizing out-of-pocket expenses and hidden costs.

This partnership reflects our dedication to providing top-notch care while accommodating the financial needs of our community, including exceptional support for our teachers and military personnel.

Suppose Patuxent Orthodontics is within your insurance network. In that case, you typically benefit from a contractual discount on the cost of your treatment and what your insurance contributes to orthodontic care.

Orthodontic insurance generally covers $1000-$2000 over the treatment period at 50%, representing a once-in-a-lifetime benefit. Hence, maintaining the same insurance provider throughout your treatment is crucial to avoid unforeseen additional costs associated with insurance changes.

What Part of Orthodontic Care Is Typically Covered by Maryland Insurance Providers?

In Maryland, dental insurance plans often include coverage for various orthodontic treatments, helping reduce the financial burden for families and individuals pursuing a healthier, straighter smile. Most insurance plans cover a portion of the cost for traditional braces, which include metal braces, ceramic braces, and lingual braces, as well as more discreet options like invisible braces and clear aligners.

The extent of insurance coverage can vary significantly between different health insurance companies and specific dental insurance plans. Insurance plans typically cover a percentage of the orthodontic treatment costs or provide a fixed dollar amount. This coverage often includes initial consultations, regular adjustments, and some necessary additional treatments. However, there are limits and conditions, such as lifetime maximums, which cap the total amount an insurance plan will pay toward orthodontic care.

Insurance benefits also cover other related dental procedures needed to support orthodontic treatment, like treatment for gum disease or tooth decay, which are essential for maintaining oral health during the alignment process. However, some costs, such as cleft lip corrections or more complex dental and orthodontic issues, might require special provisions or additional out-of-pocket expenses.

Before starting treatment, it’s crucial to discuss with both your orthodontist and insurance provider to understand the exact coverage details, including any potential hidden costs or additional costs beyond the estimated amount. This preparation helps ensure you can manage your finances effectively while achieving the desired results from your orthodontic treatment.

How Can I Maximize My Orthodontic Coverage with Maryland Insurers at Patuxent Orthodontics?

Maximizing your orthodontic coverage when working with Maryland insurers at Patuxent Orthodontics is critical to making your treatment as affordable as possible.

What Steps Should I Take to Ensure Full Insurance Coverage for My Treatment?

- Understand Your Benefits: Start by thoroughly understanding what your dental insurance plan covers. This includes knowing whether your plan covers metal, ceramic, or lingual braces. Check for specifics like covered percentages, out-of-pocket maximums, lifetime maximums, and any limitations or exclusions that apply to orthodontic care.

- Pre-Treatment Estimate: Before beginning your orthodontic treatment, request a pre-treatment estimate. This can be done through Patuxent Orthodontics, where we submit a treatment plan to your insurance company for a detailed breakdown of what costs they will cover and what will remain your financial responsibility.

- Utilize Flexible Payment Plans: At Patuxent Orthodontics, we offer flexible payment plans and 0% interest options to help manage any costs not covered by insurance. This allows you to spread the expense over time, making payments manageable within your family’s budget.

- Regular Communication with Your Insurer: Maintain regular communication with your insurance provider throughout your treatment. This ensures that you are up to date with any changes in your coverage and can adjust your payment plans accordingly.

- Annual Review: Insurance benefits can change yearly. Review your plan each year to understand any changes or new options that may benefit you, such as increased coverage for dental procedures or new technologies that might be covered.

- Direct Billing: Direct billing can simplify the process, reducing the upfront costs you must pay out-of-pocket and ensuring that claims are submitted correctly and efficiently.

By taking these steps, you can ensure that you are fully leveraging your insurance benefits while keeping your treatment affordable. Patuxent Orthodontics is here to assist you through every step of this process, from initial consultation to the successful completion of your orthodontic treatment, ensuring you achieve a beautiful smile without financial stress.

What Happens if I Lose My Insurance Mid-Treatment?

Losing your dental insurance mid-treatment can be stressful, especially when undergoing a lengthy process like orthodontic treatment.

However, there are steps you can take to manage the situation effectively:

- Contact your orthodontist’s office immediately to inform them of your situation. Patuxent Orthodontics offers flexible payment plans to help you continue your treatment without interruption. These plans can be adjusted to accommodate changes in your financial situation, ensuring that your orthodontic care, whether it involves metal braces, ceramic braces, or clear aligners, can proceed as planned.

- Explore other financing options that could substitute for your lost coverage and discuss the total cost and any additional treatments that might be needed. This proactive approach helps manage out-of-pocket expenses and keeps your treatment on track for achieving a beautiful smile.

- If you lose your insurance through no fault of your own, such as changes made by your employer, some insurance companies may provide a “treatment in progress” benefit that picks up where the previous coverage left off.

How Does Dual Insurance Work in Orthodontic Treatment?

Dual insurance coverage can minimize out-of-pocket expenses for orthodontic treatment. Both plans coordinate benefits to maximize coverage when you have dual dental insurance.

Typically, one plan is designated as the primary insurance, covering a portion of the costs. In contrast, the second plan may cover some of the remaining expenses up to the price of the treatment.

To effectively manage dual insurance in orthodontic care, it’s crucial to inform Patuxent Orthodontics of both insurance plans. The office staff will then coordinate with the insurance companies to determine how benefits are arranged, usually by submitting claims to both insurers, starting with the primary.

Coordination of Benefits (COB) depends on the specific rules of each insurance plan, and the combined coverage might not fully cover the costs of braces or other procedures, such as adjustments for misaligned teeth or treatment for gum disease.

It’s essential to understand the details and limitations of your dental insurance plans. If you have dual insurance, it is commonly assumed that you will be entitled to the orthodontic maximum from both plans. However, this depends on how your employer negotiated the second insurance.

Coordination of Benefits might mean they will not contribute further if the secondary plan does not allow for additional payments beyond the primary insurance. Understanding these details can help maximize the benefits and significantly reduce your treatment costs.

Ready for a Brighter Smile? Let’s Get Started!

Contact Patuxent Orthodontics if orthodontic care is the solution to your dental woes. Whether you want to learn more about the benefits of orthodontic care or have questions about the process, use our live chat, call (240) 802-7217, or message us through our Contact Us page to connect with our friendly staff today and book a complimentary consultation!

Our office, located at 44220 Airport View Dr., Hollywood, MD 20636, proudly serves Maryland’s Patuxent area, as well as the Greater Washington DC area. So, if you’re residing in Hollywood, Wildewood, or Leonardtown and are looking for one of the best orthodontists in Maryland, don’t hesitate to visit our office!

We also invite you to keep up with our blog to get answers to many of the frequently asked questions about maintaining your perfect smile, and follow us on Facebook and Instagram to become a part of our smiling community!